cFO services

Many small and medium organizations make plans to add a Chief Financial Officer (CFO) once they have reached certain benchmarks (i.e. sales and profit levels), not realizing the importance of right CFO who could be the key to achieve those targets. CFO services is the solution to their financial management needs.

Full time CFO is too expensive to afford by SMEs. We offer a cost effective alternative to a full-time CFO by providing remote / virtual / shared CFO services. We work directly with entrepreneurs, owners, CEOs and management to improve a company’s financial health.

who is CFO services for?

Virtual CFO works like a right hand person. He is there to help CEO to make right and informed decisions, inform him about financial dangers or opportunities.

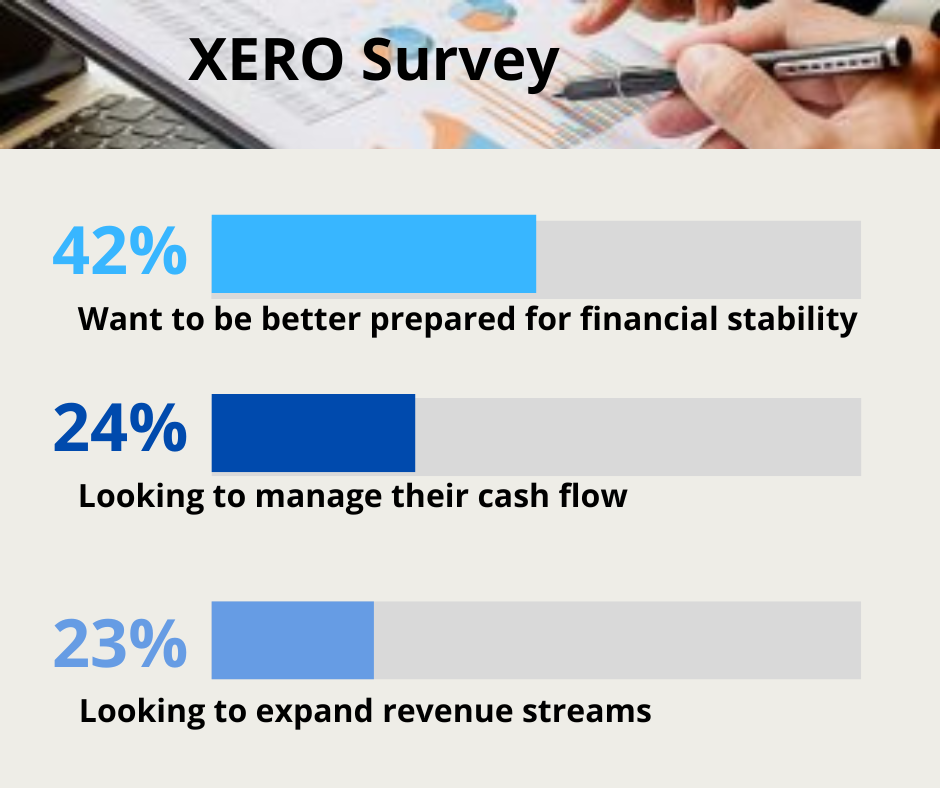

According to a survey conducted by Xero following are the 3 main objectives of small and medium enterprises:

- 42% wants to be better prepared for financial stability

- 24% looking to better manage their cash flow

- 23% looking to expand revenue streams.

This indicates that Financial planning, monitoring and control is the major concern of startup and small & medium enterprises.

Following can benefit from shared CFO services:

- Startups looking to growth.

- Small & Mid Sized companies and startups having a high demand of reporting from investors.

- Companies being in resource shortage for finance expertise or skills.

- Companies that need data quality and reporting improvements

benefits of Virtual CFO

Financial Monitoring, Control and Compliance:

Your virtual CFO will keep a vigilant eye on your day to day financial transactions and oversee & control financial operations.

Financial Planning & Analysis:

- Comprehensive analysis of company’s past performance including income, expenses and financial statements.

- Mapping out company’s financial future by planning capital investments and creating financial models to help guide business growth.

- Financial statement preparation and review for accuracy.

- Budgets

- Financial Forecasts

- Financial Projections.

Cash Flow Forecasting:

- Detailed review of the company’s cash inflows and outflows.

- Create scenarios that consider potential cash flow issues.

- Monitor results in real-time and continuously adjust forecast.

KPIs and Metrics:

- Developing key performance indicators to measure how effectively a company is achieving business goals.

- Collaborate with management on specific metrics to evaluate performance.

Financial Projections & forecasts

Even if you are not on monthly CFO services, you can get one time service for the following:

- Projected Financial Statements

- Financial Forecasts

- Financial Model

- Financial Analysis

- Budget

- Real Financial Statements

- Balance Sheet

- Profit & Loss Account

- Cash Flow Statement