Professional bookkeeping & accounting services

For Nonprofits, Small Businesses, Real Estate & property Management, and Tech & Creative Agencies

Whether you’re running a Nonprofit organization or a For-Profit business, maintaining accurate books is essential for compliance, transparency, and informed decision-making.

At Bajwa Bookkeeping, we provide reliable and professional bookkeeping and accounting services tailored to your organization’s structure and goals.

In Nonprofits, the focus is on accountability — ensuring every donation and grant is properly tracked.

In For-Profit entities, the focus is on profitability — keeping your finances accurate and ready for growth

🧩 Our Core Bookkeeping Services Include:

Company setup in accounting software (QuickBooks Online, Xero, ZohoBooks, Aplos, Wave)

Professional Chart of Accounts setup

Catch up and clean-up of backlog transactions

Recording and categorization of sales, expenses, and payroll

Bank Reconciliations

Credit Card and PayPal Reconciliations

Financial Statements (Profit & Loss, Balance Sheet, Cash Flow)

Financial Analysis & Management Reporting

💼 Industry-Specific Expertise:

We specialize in bookkeeping for:

Nonprofit Organizations

Service & General Businesses

Real Estate & Property Management

Tech & Creative Agencies

You can buy our services through:

💻 Bookkeeping Software expertise

Services are offered in the following renowned online Accounting software:

1- QuickBooks Online 2- Xero Accounting 3- Aplos 4- Zoho Books 5- Wave Accounting 6- FreshBooks- 7- Odoo 8- Myob

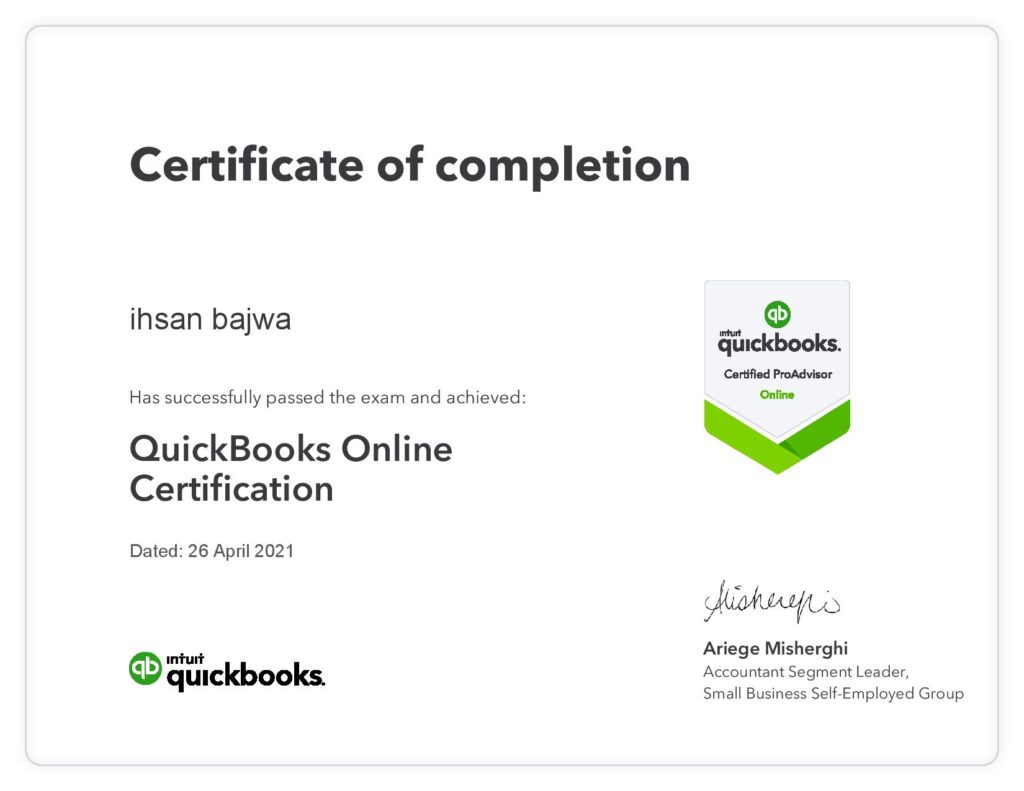

🏅 Software Certifications

QuickBooks Online Advanced ProAdvisor

QuickBooks Online Payroll Advisor

Xero Advisor Certified

QuickBooks Online ProAdvisor

🧭 why Outsource bookkeeping:

As a small or medium-sized business owner — or a nonprofit leader — most of your day is spent managing operations, serving clients, or running programs.

Sales (or donations, in the case of nonprofits) deserve your full attention if you want to grow and succeed.

At the end of a busy day, the last thing you want to do is handle spreadsheets, bank reconciliations, and financial reports.

Bookkeeping requires both time and accounting expertise — and mistakes can be costly.

That’s where outsourced bookkeeping makes perfect sense. It’s cost-effective, accurate, and stress-free — allowing you to focus on what truly matters: growing your mission or business.

6 Great Reasons to Outsource Your Bookkeeping and Accounting

✅ 1. Save on Staffing & Payroll Costs

No need to hire a full-time accountant — get professional bookkeeping at a fraction of the cost.

✅ 2. Work with Qualified Experts

Your books are managed by certified professionals experienced in QuickBooks Online, Xero, and nonprofit fund accounting.

✅ 3. Focus on Growth

Spend more time on your business or programs while we keep your finances organized.

✅ 4. Enjoy a Stress-Free Year-End

We handle reconciliations and reporting so tax time or audit season goes smoothly.

✅ 5. Scale with Confidence

Our bookkeeping grows with your business — from startup to established enterprise.

✅ 6. Ensure Accuracy & Compliance

Timely reconciliations and error-free financial statements mean you always have reliable data.

🤝 Partner with Us for Subcontracted Bookkeeping Services

If you’re a busy accounting or tax professional, managing your clients’ books in-house can take valuable time away from your core business.

We offer white-label bookkeeping services so you can serve more clients without hiring additional staff — while maintaining accuracy, confidentiality, and efficiency.

The following professionals can confidently subcontract bookkeeping and accounting work to us:

CPA Firms

Enrolled Agents (EAs)

Corporate and Business Consultants

Focus on growing your firm — let Bajwa Bookkeeping handle your clients’ day-to-day bookkeeping at economical rates, with timely reporting, and professional precision.